21 Ways SnapChatters Are Making Extra Money in 2018

September 12, 2018 at 11:19 am EDT | Sponsored Content

How much money would you like to have saved by the end of 2018? Or for your next vacation? Or to pay off your student loans?

Whatever your goal, the number probably seems overwhelming.

Trying to figure out where several hundred or thousands of dollars might come from is tough. Instead, break it down. Find ways to set aside just a little bit at a time — you’ll be surprised how quickly you can move toward your goal!

To help you get started with that first step, we’ve put together 21 easy things you can do to help save and make more money this year! Not only can you read about them here, you can click the links provided if you want to take advantage of these ideas right now.

1. Get Paid To Take Online Surveys

Let’s face it, a lot of us have a bit of extra time on our hands that we just spend watching TV. What if you could get paid a little bit of extra pocket money just for taking a few online surveys? Would you do it? There’s a new website called Survey Junkie that allows you to do just that. You provide them with a bit of information about yourself and they’ll match you up with to surveys that you can complete for big brands. You then earn rewards and virtual points that you can redeem for Paypal or e-Giftcards. You won’t make a ton of money doing this, but it could help pay for a few things every month and it’s easy to do. You can use this money to help pay off your lingering student debts.

Learn More About Survey Junkie »2. Claim Free Everyday Household Products

Here’s a little tip most Americans aren’t told about. Chances are you purchase the same household products on a daily/weekly basis. But what if you could get free samples sent to you from these very same manufacturers? Not a lot of millennials know about it, but you can actually claim free samples from top brands. If you’re looking for a way to get household goods, pet food samples, sweet treats, posters, days out vouchers and much more, we recommend signing up for the Free Samples Guide. Once you provide them with your email address, they’ll let you know when you’re eligible for the latest free samples and how to claim them.

Learn More About Free Samples Guide »3. Do Gigs on Fiverr

No matter what type of service you offer, you can likely offer it on Fivver. This is terrific for digital services such as graphic design, web design, short audio or video clip creation, editing services, writing and so on. If you have a bit of extra time and have decent command of the English language – you can make some good extra cash just from writing a few articles. Trust me, if you're in College right now or just finished graduating from College, you can probably write a few articles a day no problem (and make good bank doing it).

Fivver has expanded beyond just the $5-per-gig model. Fiverr Pro pools the best talent on its platform. Depending on your skills, you could do considerably well on here. There are even some people making 6 to 7 figures a year just from Fiverr!

Learn More About Fiverr »4. Get a Lower Auto Insurance Rate – Pay Less Than $50/Month

Would you like to pay less than $50 per month for your car insurance? Car insurance is mandatory for every driver, but that does not mean you have to pay an excessive premium. If you have no accidents or violations in the past two years, you can probably get a much lower rate than you currently pay and join the 5% of Americans who figured out how to pay less than $50 a month! In the past, you’d have to shop around and call several companies to compare rates. Today, you can use a website tool that shows you comparable rates from top companies, letting you make the clear choice. See how low you can get your rate and tell your friends!

Get a Lower Auto Insurance Rate »5. Consolidate All Your Existing Debt Into One Simple Payment

Okay, so maybe your credit card debt and student debt seems overwhelming to repay. If that's the case, then this tip is probably for you. Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $10,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

Learn More About Debt consolidation »6. Cut The Cord on Cable Forever

Millions of Americans are completely cutting the cord on their monthly cable costs, allowing them to save $100+ per month in unnecessary fees. Many of them are switching to Netflix or Amazon Prime Video subscriptions, but there are also other ways you can get cable channels without needing to pay a monthly fee. All your local news, weather, sitcoms, cooking shows, kid’s shows, sports and thousands of movies are available for free with a Digital antenna. In fact, most broadcast stations offer additional regional programming, absolutely free. The SkyLink digital antenna simply attaches to your current TV’s antenna jack (all TV’s have them), and then you get to enjoy Free Broadcast TV. It supports 1080p HDTV and has up to 30 miles of range, so it’s nothing like the “rabbit ears” people used in the past. If you find you’re not watching as much television as you used to, this could be the perfect solution for you and can save you a lot of money every month.

Learn More About SkyLink »7. Get Money Back Instantly For Stuff You’ve Already Bought

Do you love getting refunds? How cool would it be to get money back on stuff you’ve already bought without having to do a thing? Paribus is an app that lets you find out if stores you’ve shopped at online owe you a refund. It’s free to sign up. Paribus connects to your email account and checks your receipts. If they find out a retailer has dropped their price they file a price adjustment claim for you automatically. Try out Paribus.

Paribus works with a huge number of merchants that you probably already shop at, including Walmart, Amazon, Costco, Best Buy, Target, Apple, Kohl’s, and more!

Learn More About Paribus »8. Rent a Spare Room on AirBNB

AirBnB can s a terrific platform for renting out a spare room. You can make some good money, especially if you live in a tourist destination. If you don’t mind the neighbors, then this is definitely an option. You can crash with friends and family and rent out your entire house if you’re really desperate.

Learn More About AirBNB »9. If You Own A House...Negotiate A Better Mortgage Rate With HARP

If you’re a homeowner and you want to save yourself thousands of dollars this year, there’s a program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) could help hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017 but has been extended to 2018 for the time being. In order to qualify for HARP you’ll need good or excellent credit, so if you don’t have a very good credit rating then this probably isn’t for you. To check if you qualify visit HARP Approvals, and fill out the short quiz (take 2 minutes). If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings would help you, then this could be the easiest money savings tip you take.

Learn More About HARP »10. Get Paid To Organize Homes

You could easily do home organizing for people. If you’re a tidy and organized person yourself, and you’re good at organizing spaces, why not offer your services to people around you? You’d be surprised at how many people, even on your own social media feed, might take you up on doing something like this.

Again, a site like Care.com also helps to connect home organizers with people looking for this type of service. It all depends on whether you want to go through a professional company or pitch it yourself to people that are already in your personal or business network.

Learn More About Care.com »11. Invest In The Booming Marijuana Industry Before 2019

If there's one thing millennials should know, it's that marijuana stocks are set to explode as the United States moves more and more towards legalization. As medical marijuana begins legalizing in all 50 states, an expected 4,067% industry boom will transform the average American’s savings into early retirement nest eggs. If you have any money you can set aside to get in on this next big industry, now is the time to act. Looking to learn more about the growing marijuana industry? Watch this video now.

Click Here To Watch The Video »12. Claim Your Free 72 Hour Survival Food Kit

This special promotion is currently available to help anyone prepare for disasters. With floods, tornadoes, and other natural disasters on the rise, this company decided that they wanted every one to have access to their survival food kits. That’s why they currently have a special promotion for American citizens to get a free 72 hour survival food kit (just pay the S&H fee).

They source most of their raw ingredients from the “fresh produce” category – picture the delicious veggies you find in season at your local farmer’s market. No harmful chemicals, no GMOs and no added MSG. They also combine their top-quality ingredients using prize-winning recipes so that they’re loaded with flavor. Many of their recipes have won independent taste tests. We recommend giving them a try and taking advantage of this special offer.

Learn More About 72 Hour Survival Food Kit »13. Start Investing (Even If You're Not Rich)

You’ve been thinking about investing because you’re supposed to make your money. You know that you could use a little advice, but financial advisers are expensive, right?

Not always. With Blooom, you get all of the advantages of an investment app along with the ability to set up your financial game plan with a live financial adviser.

Plus, it lets you get started with no minimum investment and no hidden fees.

You can sign up online, through the Blooom website, or get that personal touch and set up a call with a real financial adviser. It only takes five minutes. You’ll have to provide some personal information like your Social Security number, but only because Uncle Sam requires it for Blooom to do its job.

Learn More About Blooom »14. Learn How To Make Money With Daily Fantasy Sports

No doubt you've seen all the commercials by now for FanDuel and DraftKings, but have you ever given any thought to making money with daily fantasy sports? There are thousands of people who are making a full time income just by participating in these daily tournaments. Some of them are even making over $100,000 per year. Most people think these tournaments are all based on luck, but in reality it turns out it's more like poker in the sense that you are playing against other people and there's a lot of skill involved. If you're interested in learning more about making money with daily fantasy sports we recommend you watch this video from Playmakers Portfolio. They will teach you the ins and outs of how to win in these daily tournaments.

Learn More About Playmakers Portfolio »15. Get Rewards for Paying Your Bills on Time

Your mom probably gave you an allowance for washing the dishes and sweeping the floor when you were a kid. Now all you get for doing it is a kitchen that’s clean for, like, 15 minutes.

As an adult, you don’t typically get rewards for doing things that are expected of you… until now.

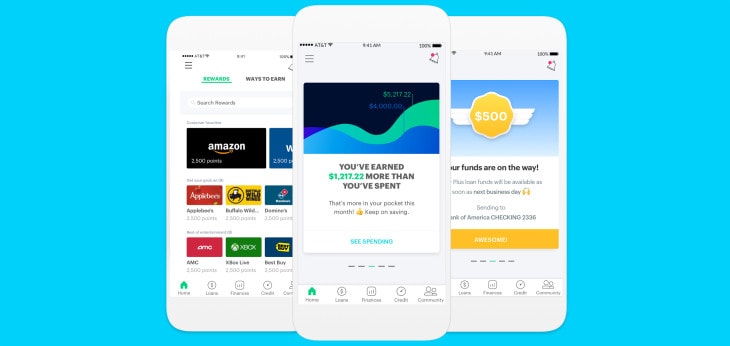

This app kind of rules them all: MoneyLion, a free all-in-one app for managing your personal finances.

MoneyLion offers rewards to help you develop healthy financial habits and will literally pay you for logging onto the app.

You can earn points in the rewards program by paying bills on time, connecting your bank account or downloading the mobile app.

You can redeem those points for gift cards to retailers like Amazon, Apple and Walmart.

If credit cards aren’t your thing, MoneyLion is like having a rewards credit card without the temptation to overspend.

The app also connects with all your bank, credit card, student loan and other financial accounts. Based on your income and spending patterns, it offers personalized advice to help you save money, reduce your debt and improve your credit.

Learn More About MoneyLion »16. Take a Deep Breath and Check Your Credit Score

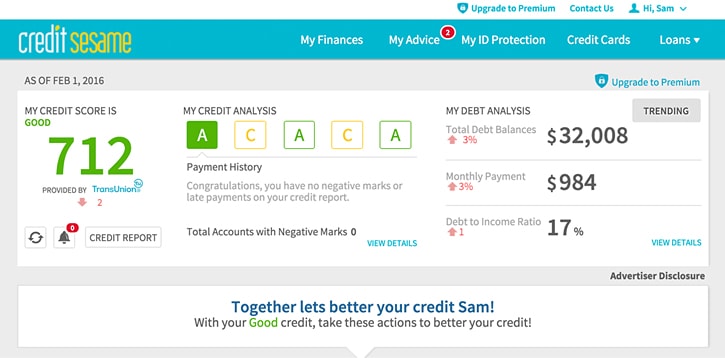

One of the judgiest parts of personal finance comes with that three-digit numeral.

It’s called a credit score, and the mere mention of it might send you spiraling back to high school when your worth was measured on a 4.0 scale. But with a credit score, it’s different. You can actually make large strides to improve it — without having to become the teacher’s pet.

Credit Sesame can help you get there. It will provide you a free credit report card — including your credit score. It breaks your score down and grades different aspects of your credit profile.

But don’t worry. If you see a big fat “D” or “F,” Credit Sesame gives you personalized reasoning and recommendations on how to improve your grade.

Jerry Morgan signed up for Credit Sesame, and in about six months he was able to increase his credit score 120 points, thanks to the platform’s suggestions and resources. You can read his Credit Sesame review here.

No extra credit required.

Learn More About Credit Sesame »17. FIXD – Save Thousands on Car Repairs!

Have you ever gone to an auto repair shop for an oil change, only to have the mechanic say you need a new transmission? Or has the mysterious “check engine” light come on, and next thing you know the mechanic has a list of expensive engine parts that need replacing? Unfortunately, mechanics know taking advantage of people is easy, given their lack of knowledge about car maintenance needs. But there’s a new device you can carry with you in your car to tell you exactly what’s wrong with it. If you own a car built after 1996 then you can use this brilliant new device called Fixd to instantly diagnose any car problems. This means the next time your “Check Engine Light” happens to come on, you’ll know exactly what the issue is and the Mechanics won’t be able to lie to you! In the United States alone, this product did over $50,000,000 in sales in 2017.

Learn More About FIXD »18. Drive For Lyft

Need a fun, flexible way to earn money this month? Try driving with Lyft! Demand for ridesharing has been growing like crazy, and it shows no signs of slowing down. To be eligible, you’ll need to be at least 21 years old with a year of driving experience, pass a background check and own a car made in 2007 or later.

We talked to Paul Pruce, who’s been driving full-time with Lyft for over a year. He earns $750 a week as a driver. Best of all, he does it on his own time. You can work days, nights or weekends — it’s up to you! Work 40 hours a week for one month, and you could bank up to $2,400. Just remember to include the cost of gas and car maintenance in your profit calculations.

Learn More About Lyft »19. Sell on CaféPress or Etsy

If you can design digital items, you can sell them for a share of the profits on a site like CafePress. You can do this with nothing more than some design software. They can include custom logos, inspirational sayings and other topical or trending designs appealing to the masses.

You could hire a designer to assist you with this, but you still need to come up with the ideas. This works best if you understand design yourself but requires no overhead. Items are printed and delivered on-demand. You simply receive a share of the proceeds. Similarly, you could sell items on Etsy as well.

Learn More About Etsy »20. Learn How To Start Your Own Online Business

Maybe you're tired of working for someone else and want an easy way to make money from home without having an annoying boss always looking over your shoulder. If that's the case, there are several ways you can make money online. Many entrepreneurs are turning to something called Affiliate Marketing (an $8 Billion Dollar A Year Industry) to make money from home. Affiliate marketing involves receiving a commission for selling other people's products or services on the Internet. You can watch this video to learn how some people are earning $500+ per day from this growing industry.

Learn More About Affiliate Marketing »21. Walk Dogs To Get Paid

There are networks devoted connecting dog owners with dog walkers. Rover is one of the largest networks of dog walkers out there. Of course, you could also use social media or just knock on neighbors doors to advertise your services, but you can easily use one of these services. Not only will this help your bank account but it will also help keep you fit!

Learn More About Rover »