For many retirees, insufficient cash flow is a major issue which affects overall quality of life.

That’s why I put together this briefing.

It’s a list of 11 practical, actionable and unique retirement “hacks” designed to help you boost your income and save thousands of dollars a year.

Don’t lose out on these simple ways to improve your financial situation (most of them only take a few minutes).

Let’s begin:

#1 Travel first class… for free

Do you have good credit? Always pay your bills on time?

Is there anything better than traveling for free… or next to nothing? Rewards cards like the Chase Sapphire Preferred are popular for their ability to turn points into miles and the $95 fee is waived in the 1st year.

If you feel like you couldn’t possibly spend enough to justify using the card, a simple way to “game the system” is to put all your usual expenses on the card, like groceries, clothes and car payments.

The result can be anything from free dining to flights and hotels.

#2 Never pay full price for medications again

Did you know that prescription drug prices vary quite a bit depending on the pharmacy?

So you might be paying more than you should.

Fortunately, there’s an app called GoodRx that lets users compare different prices by zip code and available options.

You can also get special discounts, coupons, price alerts and even reminders, so it’s a pretty robust app.

#3 Tax-Free Cash-Flow From Your Home

You might think that your home is an asset to constantly put money into, but it can also be a value tool to create monthly cash flow.

Enter reverse mortgages, where you “spend down” the equity in your home.

The strategy is to sell some portion of your wealth every year to meet your needs. Just don’t spend so much that you run out of money before you die!

If you’re currently have a substantial amount of equity in your home, you can probably benefit from a reverse mortgage, which functions as a home equity loan.

In fact, one of the great benefits of a reverse mortgage is that you get the money tax-free.

Why? Because the IRS doesn’t consider it income (and it shouldn’t because you’re just borrowing money you have saved in your home).

Another plus: The payments you receive will not diminish your social security payments or Medicare benefits.

If you’re interested in finding out if a reverse mortgage is right for you, the best way to do that is to speak with your lender, attorney, and appraiser.

#4 Don’t Invest In CDs Until You’ve Read This

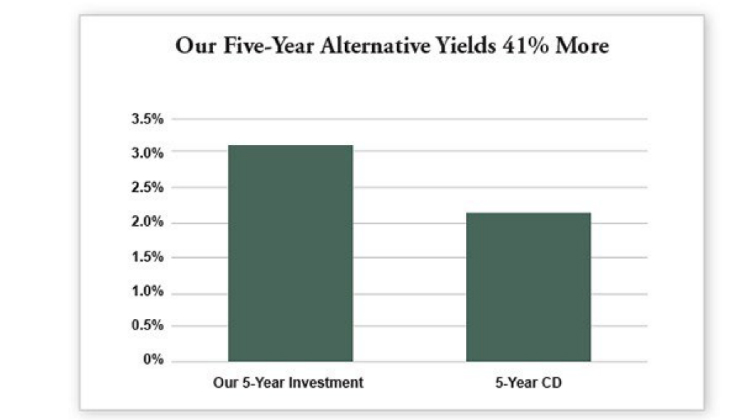

Let’s face it: CDs pay next to nothing.

You could put $10,000 into a CD for 5 years and you’ll only get $390 in return. That’s barely a car payment for a lot of people.

If you’re a retiree who uses CDs, but would prefer higher-yields, there’s an alternative similar to CDs that you might be able to take advantage of called called a “MYGA,” which stands for Multi-year Guaranteed Annuity.

What’s so great about them?

- They’re 100% tax-deferred (the income from regular CDs is taxed).

- They have higher yields (2.85% 5-year investment vs. 1.85% from a 5-year CD of a bank)

- And in some cases, you can take partial withdrawals of up to 10% annually

Most investors don’t know about MYGAs because insurance agents don’t earn much commission selling them.

But if you’re sick of seeing tiny returns with your current CDs, MYGA’s could be a fantastic alternative.

#5 Stop paying for cable TV

If you’re sick and tired of paying for cable, there’s are streaming services that you might be able to take advantage of like Apple TV, Roku or Google Chromecast – and an HD antenna.

These streaming media players are small devices that attach to your TV and give you access to hundreds of shows and movies (unfortunately, you can’t watch live TV like sporting events).

If you want even more content, you can subscribe to streaming services like Netflix or Hulu. And if you’re already an Amazon Prime subscriber, they also have many shows and movies available for viewing.

#6 “Hidden” Yield With Special Dividends

This unique idea is for income investors, so if you’re a retiree looking for a simple way to boost your income, this could be perfect for you.

Did you know that for nearly a decade now, a select group of America’s top-shelf companies have been paying unscheduled special dividends to shareholders?

As you know, dividend stocks typically pay out four times per year. But this special group of companies pay shareholders as much as five times each year.

Of the 5,000 companies on the American stock exchange, only a relatively small portion of them distribute this special dividend. And they don’t advertise these secret payments – somebody has to go looking for them.

So what exactly are these special dividends?

They’re “one-off” dividends paid out when companies want to return extra cash to shareholders, but don’t want to cause a spike in their regular dividend payments. In other words, they’re non-recurring payments.

This simply means more money in your pocket. Best of all, these special dividends are often much larger than regular dividends (usually 2-3 times more!).

If you’re interested in additional dividend payments every year (and who wouldn’t be?), look into special dividends today.

#7 Reduce your cell phone bill up to 90%

You might think there’s no way to reduce the sky-high fees on international calls, but for only $20 you can get a local phone number and a one-month plan with Skype.

Plus when you’re connecting to WiFi abroad, you can use the Skype app on your phone to make and receive calls. And if you want to use the service just to call other Skype users, you can do it completely free.

#8 Use Peer-to-Peer Lending as a fixed-income platform

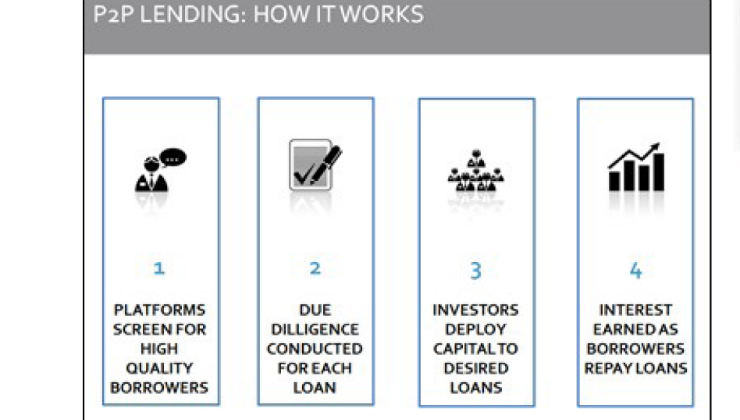

If you’re a retiree and you want a low-risk way to generate passive income (with potential double-digit returns), there’s a unique investment platform that you might be able to take advantage of called peer-to-peer lending.

Peer-to-peer lending is simply people with money (investors) lending to people who need money (borrowers).

They both cut out the “middleman’—such as a bank—to do business directly with each other.

The rapid rise in social lending platforms like Lending Club and Prosper could help hundreds of thousands of Americans get a nice return on investment.

The latest yields are 3 to 7 times higher than yields of CDs and savings accounts, and many investors who own 100-plus notes of relatively equal size have seen positive returns, according to Lending Club.

To get started, you’ll need your routing and account numbers and the sign-up process takes less than 5 minutes.

#9 Cut the cost of your internet service

If you’re feeling a little overwhelmed by the mounting fixed expenses you shell out every month for services and utilities, you’re not alone.

Luckily, there are hundreds of simple ways to reduce your costs.

For example, your monthly internet bill is a “quick win” you can take care of easily. All you have to do… is ask.

Most people never think to do it, but just asking your internet service provider (or cell phone company) if they can lower your rates is an easy way to save money.

Now this won’t work with every company, but you’ll be surprised how just asking for a better deal is often all you need to do.

#10 Guaranteed Income with QLACs

What the heck is a QLAC?

QLAC stands for Qualified Longevity Annuity Contract. It’s an annuity payment similar to Social Security.

You see, when you choose to delay your Social Security payment, that’s essentially a longevity annuity structure.

A longevity annuity is a fixed annuity that guarantees a future income stream at a date you specify, so if you’re retired (or will be soon), this type of annuity could be perfect for you.

Traditional IRA holders are also being encouraged to use the QLAC strategy. This is exciting because people can lower their required minimum distribution on their IRAs and potentially reduce taxes on their overall taxable income.

One of the benefits no one is talking about is that both you and your spouse can take advantage of the QLAC rules. In fact, the lifetime guarantee if for both lives, regardless of how long either of you live.

One of the common misconceptions with annuity lifetime income streams is that if you die, the greedy annuity company gets to keep your money. That’s definitely not the case with many QLACs (it all comes down to how you structure the payment).

It’s really important seniors have a guaranteed income stream as they get older, especially if they run into unexpected expenses and financial burdens, so a QLAC might be for you.

#11 “Washington’s Private Pension Plan” – 10X Better Than Social Security?

A select group of D.C. elites do NOT collect Social Security, according to a government watch-dog’s new investigation. Instead, 351 Congressmen and thousands of insiders have access to a secret alternative&emdash;one that can pay up to $11,334 every month, for life.

That’s 10 times MORE than the average Social Security check…

So it’s no surprise the New York Times says Congressmen “shy away from talking about” this alternative. Or that the Des Moines Register describes it as “shrouded in secrecy,”.

Again: This has nothing to do with ordinary Social Security. It’s different and superior in every way.

“It’s like Social Security on steroids,”