Homeowners Are Being Urged to Claim Their Mortgage Savings (Before They Expire)

A "mysteriously forgotten" program has re-emerged, which can save millions of middle-class Americans thousands per year (but banks are trying to keep it hidden).

How Does It Work?

HARP is a Special Mortgage Program that has been in place since the housing crash of 2008. But in all these years, it has rarely been talked about, mostly because banks don't want you to take advantage of it.

Recent interest rate hikes have just made it re-surface and banks are furious. Homeowners will now be able to reduce their monthly mortgage bills and keep the difference in their pockets.

HARP is a Special Mortgage Reduction program and there is no cost & no obligation to See if you qualify »

Important: Even if you've applied for HARP before and were denied, you should try again now. The qualifications for approval have been dramatically reduced in 2018.

But... there has been an announcement that it will expire as soon as this year, so right now there is a big push urging homeowners to take advantage of this program.

And with many economists expecting another interest rate hike this December, the longer you wait, the less help you will receive on your mortgage payments.

So if lowering your payments, paying off your mortgage faster, and even taking some cash out would help you, it is vital you act now before it's too late.

Big Mortgage Savings For Homeowners

If your mortgage is less than $625,000, your chances of qualifying for HARP could be high. This is a stimulus program that aims to put more money back into the pockets of average citizens so that it can ultimately boost the economy.

However, the banks are not happy about this. Here's why:

- The HARP Special Program makes it easier to qualify for lower mortgage rates

- You have the option to shop for other lenders

You think banks like the above? Rest assured, they do not. They would rather make more money by keeping you at your current higher interest rate. The middle class seems to miss out on everything, and jumping on this benefit is a no-brainer.

Why Should You Care?

- It’s insane these programs aren’t talked about more often. For whatever reason, a lot of people think they are “too good to be true”. Even worse, some think the program is only for homeowners with bad credit or foreclosures. This couldn’t be farther from the truth. Homeowner programs are made for the average American.

- And having good credit could help you qualify for EVEN more cash!

- As far as we are aware, deadlines for these programs haven’t yet been announced, but if transforming your home, paying off debts, or even just taking the cash for a vacation or new car would help you, it’s vital to act now.

- HARP also applies to second homes and vacation homes.

- On top of the savings, many homeowners could pay off their mortgage faster.

- With home prices on the rise, homeowners can even take cash out for home improvements, pay off debt, or pay for their children's education.

Where Do I Start?

With hundreds of mortgage lenders and brokers available, it can take consumers hours to contact each one separately and request a quote.The good news is that there are services that could help you save time and money by comparing multiple lenders at once.

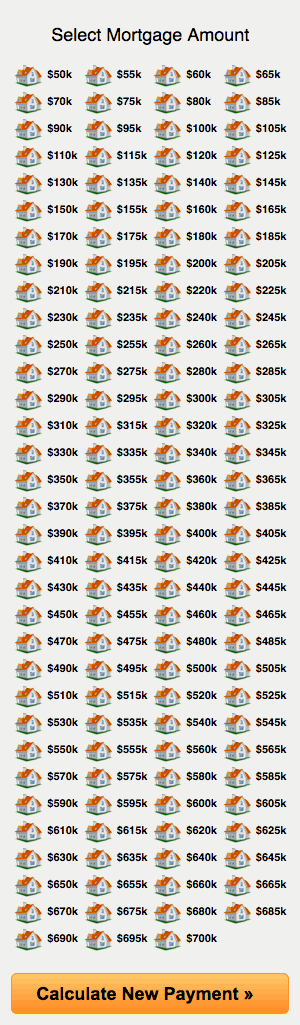

Step 1: Click Here To See If You Qualify. (This is one of the biggest HARP lender networks in the nation providing consumers with a comprehensive set of mortgage options.)

Step 2: Answer a few questions (Takes less 2-minutes) and you will be able to instantly see different quotes available to you. Under the HARP program, your rate will most likely be significantly less than what you are paying now!